Governance

Financial

The City of Brownsville has worked strategically during this past fiscal year to make strides in economic development, financial resilience, infrastructure development, technological solutions, operational analysis methods post-pandemic hiring recovery, health prioritization strategies, and property tax relief.

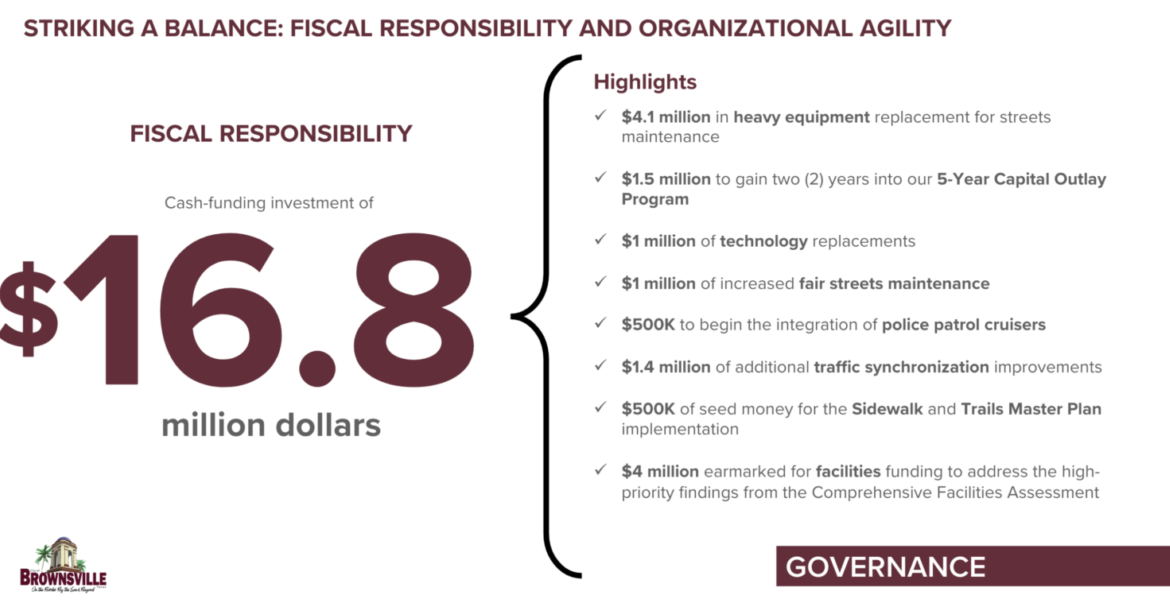

Striking a Balance

As a result of these strategic priorities, the City of Brownsville has invested $16.8 million of cash funding for:

- $4.1 million in heavy equipment replacement for streets maintenance

- $1.5 million to gain two (2) years into our 5-Year Capital Outlay Program

- $1 million of technology replacements

- $1 million of increased fair streets maintenance

- $500K to begin the integration of police patrol cruisers

- $1.4 million of additional traffic synchronization improvements

- $500K of seed money for the Sidewalk and Trails Master Plan implementation

- $4 million earmarked for facilities funding to address the high-priority findings from the Comprehensive Facilities Assessment

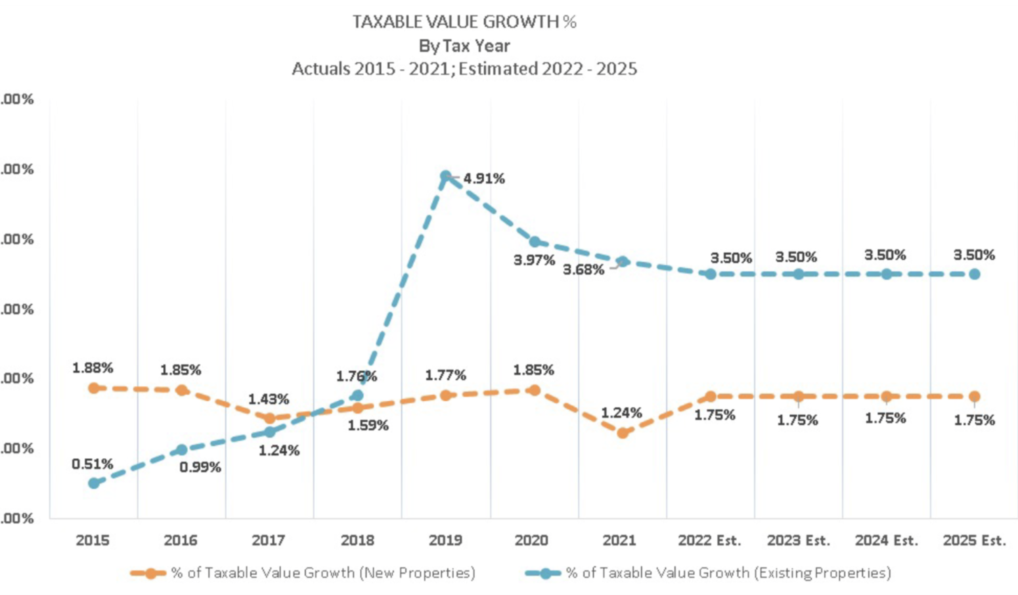

Property Tax

In 2021, the City of Brownsville lowered its tax rate to $0.697113 however the city saw a taxable value growth including industrial/commercial, residential, and personal property. In this fiscal year, the City collected Property Tax totaling $52,508,157.

Sales Tax

From October 2020 to September 2021, the City of Brownsville saw $36,627,560 in sales tax, an increase in sales tax of 17.9% over FY 2020 actual and 30.7% over what was anticipated. This surplus funding of $6.8M was allocated to fiscal year 2022 operating budget.

Organizational Journey

In August, the city hosted the 1st Annual Employee Leadership Conference where all employees were provided the opportunity to experience a conference environment on leadership development topics related to the city’s organizational culture development efforts. The leadership conference was space-themed and held at the Brownsville Events Center with 553 employees participating in-person and virtually.

Additionally, the city received an award from UTRGV for “Innovation in Professional Education.” The city has partnered with UTRGV in its Professional Development Program (PDP), a customized professional development curriculum on “soft skills” development ranging from emotional intelligence to managing conflict.

Professional Development Programs:

- Effective Motivational Leadership (EML)

- UTRGV Professional Development Program (PDP)

- LeaderGov Professional Development Program (LDP)

- Train the Trainer / Leading with Purpose

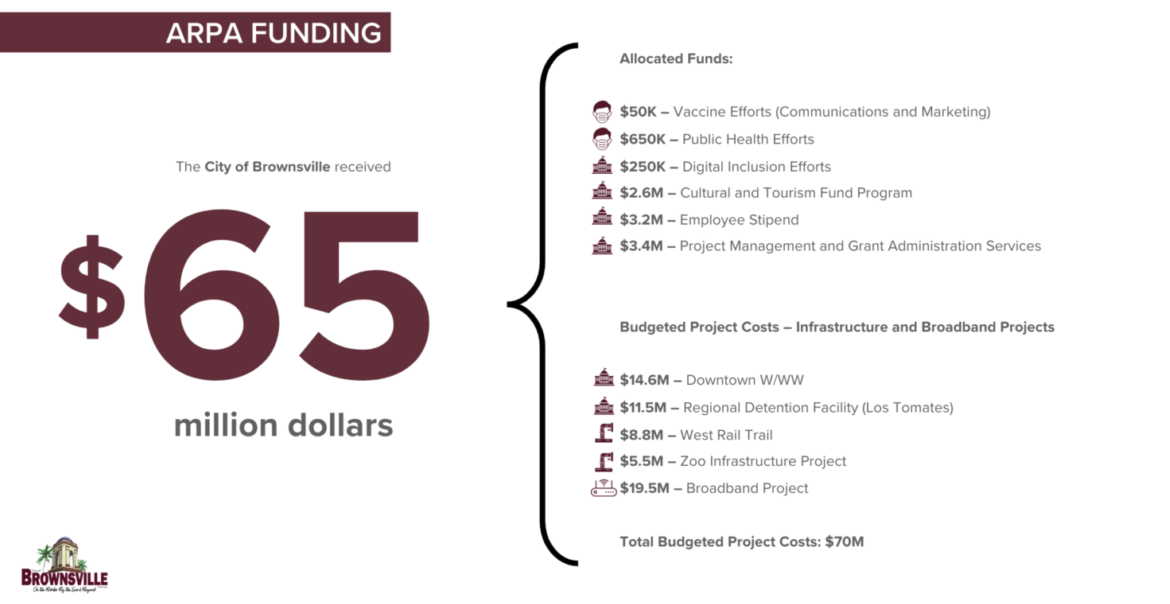

American Rescue Plan Act Funding

In June 2021, the City of Brownsville received notice of $65 million in federal assistance from the American Rescue Plan Act (ARPA).

The ARPA is a federally funded program that assists state and local governments to address four primary functions:

- Responding to the Covid-19 Pandemic

- Supporting essential workers

- Recovering revenue loss for government services

- Investing in infrastructure for water, sewage, drainage, and broadband services

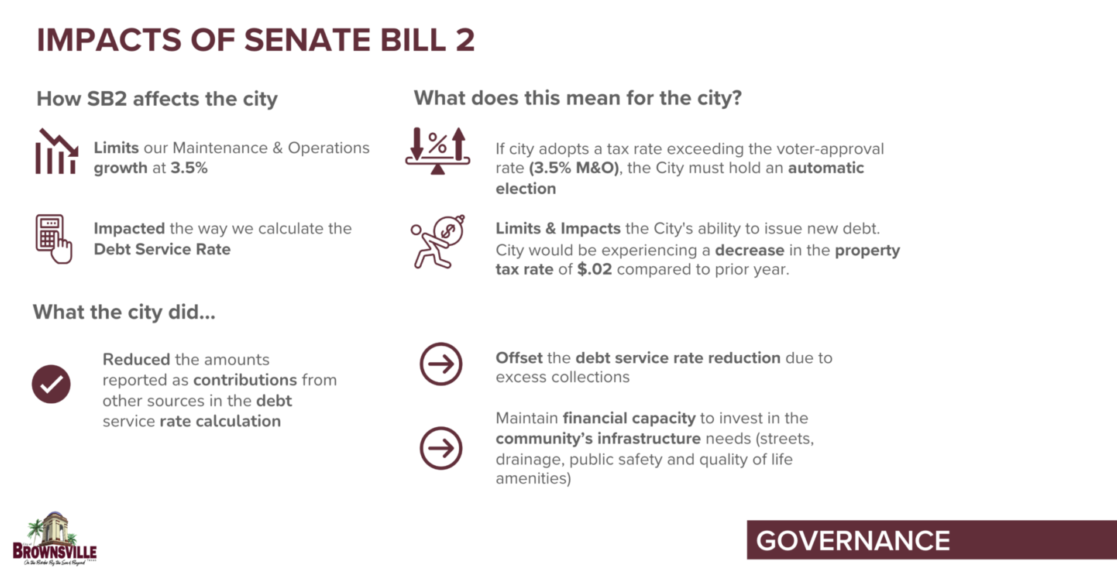

Impacts of Senate Bill 2

Senate Bill 2, also known as the “Texas Property Tax Reform and Transparency Act of 2019” makes several changes on the growth and management on property tax. This Bill affects the city by limiting maintenance and operation growth at 3.5%. As a result, the City of Brownsville has reduced the amounts reported as contributions from other sources in the debt service rate calculation.

For more information on Senate Bill 2, click here